Our website is using cookies to deliver best possible experience to you. By using it you agree to cookies policy.

This year's Digital Champions CEE 2024 ranking of the 100 largest technology companies shows that Poland has maintained its leadership position in terms of company value, with a share of more than 38% of total capitalisation. With the ongoing war in Ukraine, interest in security and cyber-security companies, as well as dual-use technologies, has increased significantly. Artificial intelligence is no longer just a fashionable buzzword and has become a key element of growth and transformation in many industries, creating new opportunities and challenges for digital champions in the region.

The combined value of phoenixes, dragons and wolves, the largest technology companies that are growing the CEE digital economy, has exceeded USD 106.95 billion. This is almost 5 per cent of CEE's GDP.

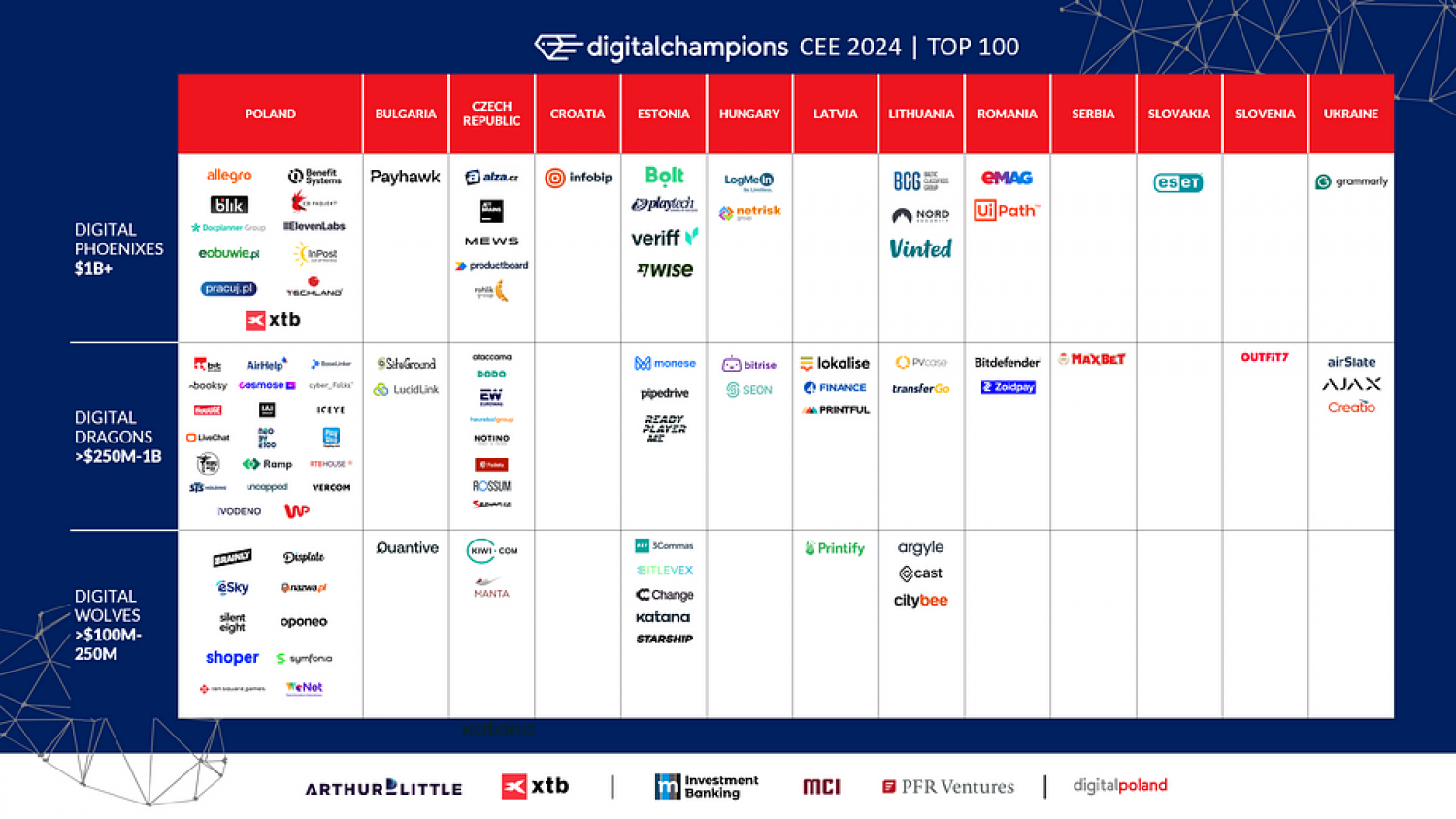

In this year's edition of the Digital Champions CEE ranking, 25 companies debuted (3 phoenixes, 13 dragons, 7 wolves). Most new champions are companies from the Fintech (10) and SaaS (6) areas.

Poland remains the region's leader in terms of the value of companies, with a total capitalisation of USD 40.67 billion which represents 38.03% of the total capitalisation of the ranking. The highest valued champions are UiPath, Wise, Allegro, Inpost and Nord Security.

Lithuania saw the largest increase in the number of champions in this year's ranking (up 60%).

The Digital Poland Foundation has prepared the Digital Champions CEE ranking for the third time. Its aim is to promote this part of Europe, create a platform for the exchange of experience between individual countries and encourage investment in technology companies in the CEE region. The ranking was created on the basis of transparent and up-to-date data and strict financial criteria.

The experts assessed the value of the companies, taking into account current public market quotations, market benchmarks, EBITDA ratios, as well as revenues. The champions included companies whose main source of profit is digital products and services or sales via digital customer reach channels.

The ranking presents three categories of digital champions according to their value:

Digital Phoenixes – 31 companies with valuations in excess of US$1bn

Digital Dragons – 47 companies with a valuation of USD 250 million - 1 billion

Digital Wolves – 22 companies with a valuation between USD 100-250 million

The data and valuations on which the ranking is based are as at 31 December 2023.

The combined capitalisation of the region's largest technology companies has increased by as much as 40.78% in the last year. This is a significant jump, showing that the technology sector in Central and Eastern Europe is growing rapidly. Despite this large increase, the value of companies is still 19.83% lower compared to the record valuations reached in 2021. This is due to a decline in the value of some companies, such as Romania's UiPath, whose valuation has decreased by almost USD 14 billion.

Polish e-commerce giants such as Allegro and InPost, and technology companies such as CD Projekt and Bolt were also heavily impacted by the reduction in valuations. In addition, Czech Avast, which was valued at more than USD 6 billion, was removed from the ranking after being acquired by another company.

– The digital economy in Central and Eastern Europe is now on a solid growth trajectory. This stabilisation has allowed digital leaders to reassert their positions and facilitated the emergence of several new champions. The valuation of the top 100 digital leaders in Central and Eastern Europe has risen from US$75.97 billion to US$106.95 billion, demonstrating the strength of the private equity sector and the growing venture capital industry - says Karim Karim Taga, Managing Partner, Head of Global Functional Practices, Arthur D. Little.

The ranking of the most valuable categories is dominated by e-commerce and SaaS (Software as a Service) companies, which together account for 62.80% of the total value of the top 100 technology companies in the CEE region. Companies operating in the SaaS (Software as a Service) model are as many as 28 in this year's ranking. Companies in the e-commerce and marketplace categories are also numerous, with 27. The largest growth of new companies was recorded in the cyber-security category. Their number increased by 25% to 5. This shows how important digital security is becoming in today's increasingly automated world.

Polish companies significantly increased their share in the total capitalisation of technology companies from 29.81% to 38.03%, allowing Poland to once again take first place in the ranking in terms of total company capitalisation. This achievement is a result of the dynamic development of the Polish technology sector and the growing interest of global investors in Polish companies.

– Poland has become a key player on the fintech scene in Central and Eastern Europe, and domestic companies have become European leaders in their categories. This will certainly help to reinforce the perception of our country as a thriving innovation hub with an extraordinary talent pool. The valuation of fintech companies managed to surpass the record levels of 2021 by almost 23%. Financial management and investment themes have entered the mainstream, which will result in dynamic growth of fintech companies in the years to come as well - emphasises Filip Kaczmarzyk, Head of Trading, XTB Board Member.

The leading positions in the Digital Champions CEE 2024 list are held by Estonia, Romania and the Czech Republic. The Baltic countries (Lithuania, Latvia, Estonia) have reduced their share of the ranking from 30.78% to 25.86%, due to Estonia's declining share (from 22.01% to 16.75%). The V4 region comprising the Czech Republic, Hungary, Poland and Slovakia accounts for as much as 52.74% of the total capitalisation. Poland (38.03%) and the Czech Republic (10.21%) have the largest share here. Slovakia has a marginal impact, accounting for just 1.3% of total capitalisation..

– One of the key long-term success factors is market liberalisation, structural reforms and growing domestic consumption. In addition, accession to the European Union has significantly strengthened the attractiveness of CEE markets to foreign investors, providing a stable legal framework and financial support in the form of funds, which has influenced regional development and improved infrastructure, creating a more favourable business environment. However, investors must carefully manage challenges such as political and geographical instability, regulatory complexities and, to some extent, infrastructure gaps. By understanding and addressing these factors, investors can take advantage of the promising prospects offered by CEE countries in terms of investment opportunities - comments Fabian Bohdziul, Head of M&A, mInvestment Banking.

Although Estonia's share of the ranking is declining, the country consistently leads the list of countries with the highest intensity of champions per population. Despite its small population (1.35 million people), Estonia outperforms other countries in the region, thanks to favourable legislation, digitalisation and the government's positive attitude towards innovation. This results in many companies from the region registering their businesses in the country to seek funding there.

- Estonia is an excellent example of how a strategic approach to digitalisation and innovation can bring significant benefits. Thanks to its friendly regulatory environment and pro-innovation policies, the country has become a magnet for technology startups and investors. It is this approach that we should be implementing across the region to attract investment and support the development of digital champions - adds Piotr Mieczkowski, dyrektor zarządzający, Fundacja Digital Poland.

From 2015 to 2022, VC investment in startups in the CEE region increased more than 13-fold. In 2023, however, there was a significant decline in fund activity, with the scale of investment falling by as much as 54%. At the same time, there was a 45% decline in Europe and a 29% decline in North America. Many investors are optimistically anticipating an increase in funding in 2024.

– We are seeing a shift among entrepreneurs who were previously employees of established technology companies and now want to build their own ventures. We believe that all of these factors will result in the emergence of a significant number of new technology companies in the coming years, especially in the later stages of development. This in turn will attract more international capital looking to boost the growth of these companies - we currently see a gap in funding for champions by international investors at the so-called growth stage, but this is largely due to an insufficient number of attractive technology companies being created locally. Overall, we are optimistic about the CEE technology space, and when we look back over the last decade, we see tremendous growth - we believe everything is in place to continue this growth trajectory - notes Michal Górecki, Senior Investment Partner, MCI Capital.

The strategic partner of this year's ranking is Arthur D. Little and XTB. MCI Capital, mInvestment Banking and PFR Ventures are also partners of the report. The honorary patron of Digital Champions CEE 2024 is the EBRD. The report can be downloaded from Fundacji Digital Poland website.